SaaSy Disclosure

There is a (very) small part of me that feels for Getswift. Not that they should be held up as any sort of role models – clearly they have gilded the Lilly a bit here and been a bit cute on withholding some thorns there. But this is hardly unique amongst start up firms. It seems that the real crime of Getswift has been that it was rather too successful in these endeavours, culminating in a fabulously overvalued capital raising. Of course bragging about these achievements probably hasn’t endeared them to anybody.

Nevertheless, the ASX campaign to get them to come clean seems to have much more to do with image management than really trying to improve disclosure standards. At the core of what the ASX allege as failing to keep the market informed seems to be a combination of not telling the market that customers had churned and using overly optimistic language in talking up their growth. They are hardly alone here.

Churn Disclosure

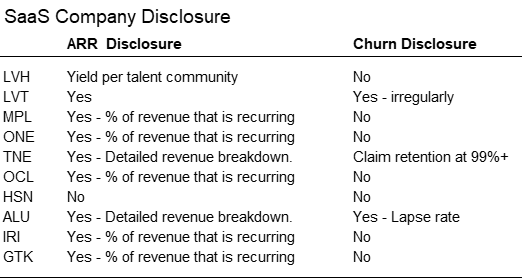

Take the issue of churn. As we argued in Saasy Stories part III, churn is arguably the most important metric for SaaS companies. It determines both the revenue potential and the return on investment for the business. It is the number that contextualises ARR and ARR growth rates. GSW did not inform the market when customers churned – but neither do many of their peers. This is true amongst both start up and more mature software companies.

As the table above shows, whilst there are plenty of companies willing to promote their recurring revenue, very few are willing to contextualise this number by disclosing churn. There are only two reasons for this – they don’t know or they don’t want to tell you. Which of these is worse depends on circumstance. But in any case churn, or some derivative or it, should be viewed as material information.

Software vs Resources

If the ASX and ASIC are going to make a big song and dance about certain companies, maybe they should get serious and introduce a standardised reporting template for SaaS companies in the same way that they do for resource companies. Revenue could be classified along a spectrum from one off to MRR much as mineral deposits are classified as reserves/resources. A similar standard for Churn might be developed. Customer acquisition costs could be standardised the same way C1 cost reporting has been tightened for resource companies.

This obviously would create some administrative burden, but is possibly a fair trade off for those companies that want to trumpet recurring revenue. And who knows, maybe forcing management to focus on some of these metrics might actually have the unintended benefit of improving longer term performance?