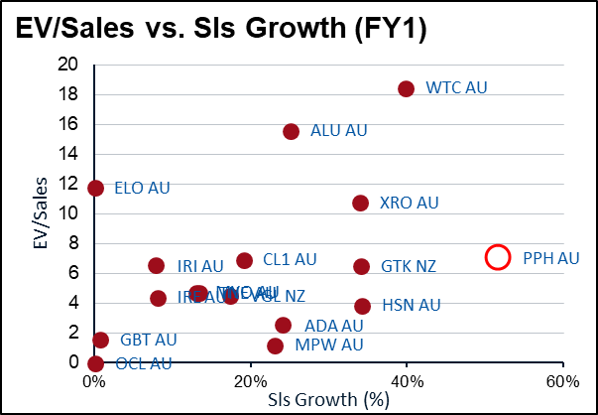

In recent posts on software companies (SaaSy Stories) and valuation (EV/Sales) we have discussed how EV/Sales is a useful valuation proxy for high growth software companies because:

- Current earnings are either negative or low – making earnings metrics ineffective;

- Gross margins are generally high and capital requirements low – making incremental return on capital very high;

- Current sales growth is a reasonable proxy for future sales potential.

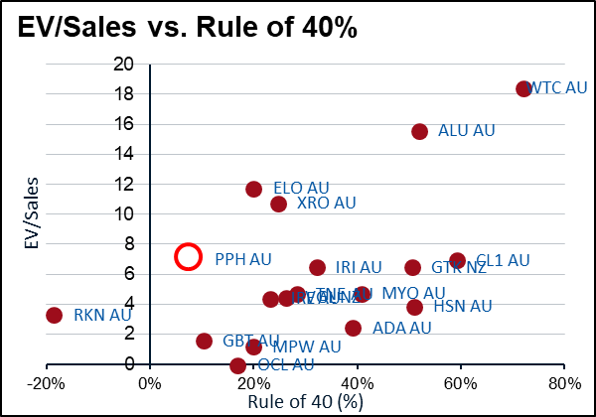

A simple plot of EV/Sales vs Sales Growth can therefore be a good initial screen for value.

Pushpay Holdings ($PPH)

On this basis, a review of Australian software stocks throws up Pushpay $PPH as being cheap. It is growing faster than Wisetech, Altium and Xero, yet trades at a significant discount on an EV/Sales basis.

DISCLOSURE: I hold positions in both ALU and XRO acquired at much lower levels. This post is NOT a recommendation that I believe these shares are still cheap.

Growth is only the start

However, as we highlighted in previous posts (SaaSy Stories I, SaaSy Stories II SaaSy Stories III), growth rates are only part of the future value creation that an EV/Sales multiple is trying to reflect. It captures a measure of potential growth, but not the return on investment to exploit that growth. It is here that the Pushpay story diverges from its more highly rated peers.

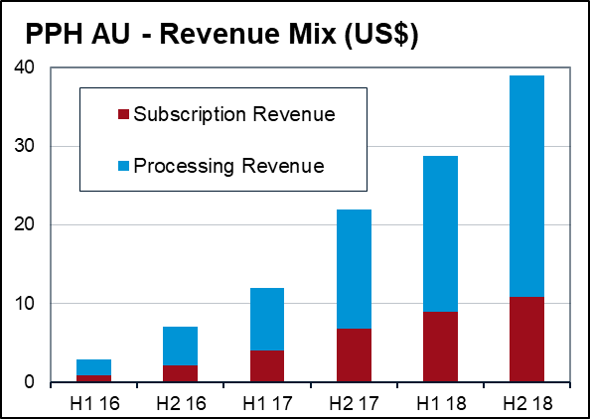

Pushpay revenue comprises two components:

- A traditional SaaS software subscription; and

- Processing fees on the volume of payments made through the platform.

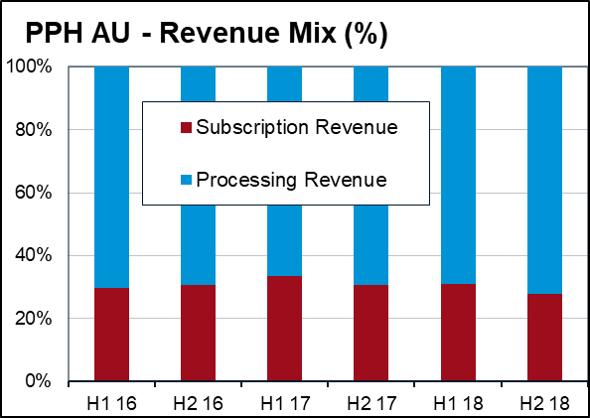

These processing fees represent ~70% of the total revenue of the business and are growing faster (85% vs 60%) than the subscription revenue. In essence, Pushpay is a payments providers with a SaaS bolt on.

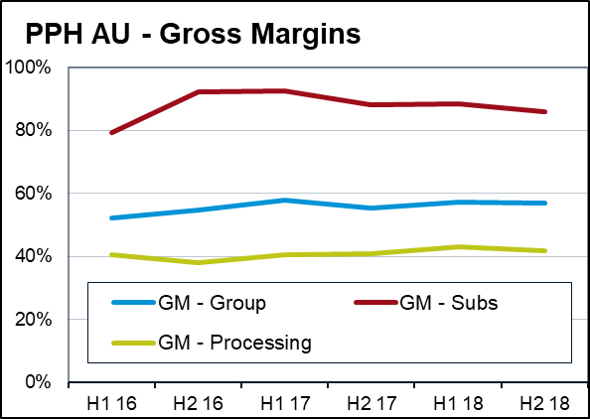

Gross Margins

The key point about these two revenue streams is their different gross margin characteristics.

- Subscription fees have gross margins >80%. This is consistent with other SaaS operators such as WTC and XRO.

- Processing fees have much lower gross margins 40-45%, due to the variable fees paid to the ultimate payment providers.

As a result group gross margins are under 60%.

Given gross margins are a key determinant of the ultimate return on investment and future margin potential of the business, we would expect terminal margins for Pushpay to be materially lower than WTC/ALU and even XRO.

Implications for Valuation

The fact that gross margins are significantly lower than pure SaaS peers does not make PPH a poor investment. It does however, mean that a simple EV/Sales comparison of PPH to peers is likely to be misleading.

One way of thinking about this is to look at net revenues rather than gross. In fact this measure might be closer to economic reality given cash flows are reported on this basis.

If we were to use net revenues then EV/Sales multiples would be closer to 11-12x revenue. Gross margins on this basis would be >90% and the stock would still probably look cheap on an EV/Sales vs Sales Growth basis.

Rule of 40%

In addition to looking at gross margins, a more detailed bottom up analysis would focus on the other key drivers of value:

- ARPU

- Churn

- Customer Acquisition Costs

Pushpay kindly provide many of these variables in a traditional SaaS format, although in my opinion this is slightly misleading. For example, like other software companies, PPH discluse an ACMR (Annualised Commited Monthly Revenue) figure. However, unlike other software companies, this revenue is not actually recurring. As noted above, the majority of revenue is transactional rather than subscription based.

A detailed bottom up analysis, which would allow comparisons of return on investment metrics between companies, will have to wait for another post. However, as we highlighted in SaaSy Stories I a good top down shortcut for this is the rule of 40% – which adds growth rates and margins together as a proxy for returns.

On this basis PPH looks only average value – good growth rates are offset by current losses. Contrast this with existing profitability of ALU and WTC and breakeven of Xero.

Conclusion

EV/Sales is a useful starting filter for investment ideas. It is not a conclusion. In particular, top down ideas generated through this process need to be filtered through a prism of more detailed bottom up analysis.

On this basis, what initially looked an attractive investment proposition in Pushpay, turns out to be a more nuanced idea requiring detailed bottom up analysis. This work may or may not come to a positive conclusion. As always do your own research, this is NOT a recommendation.