The Accruals Framework – Good vs Bad Accruals

Simply ranking firms on accruals hardly constitutes good fundamental analysis.

Overview – Good vs Bad Accruals

In many cases, earnings based on accruals are a better estimator of company performance than cash. However, this estimation is imperfect. Therefore our Accruals Framework requires a third layer of analysis that distinguishes between the good and bad components of the accruals estimate. This analysis need to consider whether the accrual is useful for predicting both company and share price performance. For example, an accrual may be so obviously poor at estimating underlying earnings that it provides little information that is not already factored into share prices.

Sloan demonstrated that on aggregate, both of these features held true of accruals. This finding unleashed a wave of further research to understand the drivers of accrual returns in more detail. This research deconstructed accruals in a few different ways:

1.Accounting Classification of Accruals

There is some evidence that good or bad accruals can be distinguished by their accounting classification.

Thomas and Zhang (2002) decomposed Sloan’s accruals into categories and demonstrated that hedge fund returns varied significantly depending upon which accrual source was traded. In particular:

- The key driver of positve returns was Inventory accruals. This could reflect either slowing end demand leading to involuntary inventory build, or over investment in inventory by management. Regardless of cause, inventory increases should not be ignored by investors.

- The least prospective strategy was payables. Intuitively this makes sense as boosting short term cash flows via failure to pay creditors appears a low quality source of cash flow.

- Hedge fund return from going long low accruals/ short high accruals decomposed by accruals source.

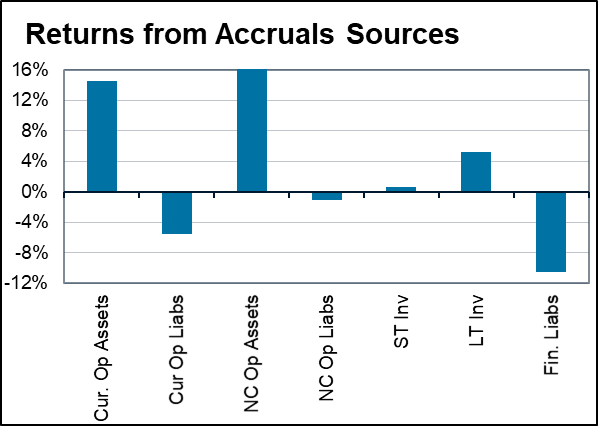

A similar study by Richardson, Sloan, Soliman and Tuna (2005) decomposed Sloan’s accrual returns into different categories that included non-current assets.

Their results showed that both Current and Non-Current Asset accruals provided valuable information, but this was less true of other elements of the balance sheet. The Authors attributed this to the reliability of the accrual estimates:

- Estimates of Receivables/Inventory and PPE/Intangibles were considered unreliable relative to estimates of payables and financial liabilities.

- This reliability reflects errors that are both deliberate and unintentional.

In summary, investors did not accurately price the statistical significance (or lack thereof) of the earnings number.

- Hedge fund return from going long low accruals/ short high accruals decomposed by accruals source.

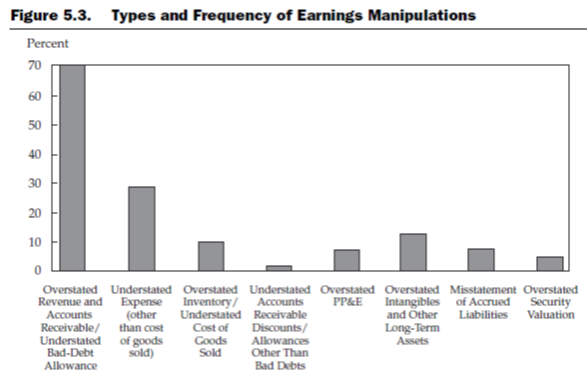

Note only do different types of accounting accrual provide different share price information, but certain types of accounting are also more likely to be manipulated.

A review of SEC enforecment releases by Dechow and Schrand highlighted that overstating revenues and understating expenses (i.e. by capitalising) were the two largest sources of error. These areas should therefore be a key focus for investors.

In summary, a key driver of whether accruals are good or bad is what type of accounting is at play. A good accruals framework therefore needs to distinguish between the overall level of accruals and the individual drivers of accruals.

2 Discretionary vs Non-Discretionary Accruals

Another way of distinguishing between accruals is to classify them as either due to the normal activities of the firm or management discretion. Non-discretionary accruals, such as those that result from underlying growth in the firm, are likley to be more reliable than those that are more subjective.

Xie (2001) decomposed accruals into those that reflected firm growth (i.e. sales) and those that did not. Using a similar approach to Sloan, hedge fund returns were significantly better using only Abnormal returns. Xie notes that this finding is robust to changes in the definition of abnormal returns “consistent with the notion that the market overprices the portion of abnormal accruals stemming from managerial discretion.”

- Hedge fund returns from normal (non-discretionary) accruals versus abnormal (discretionary) accruals.

3. Where is the accrual?

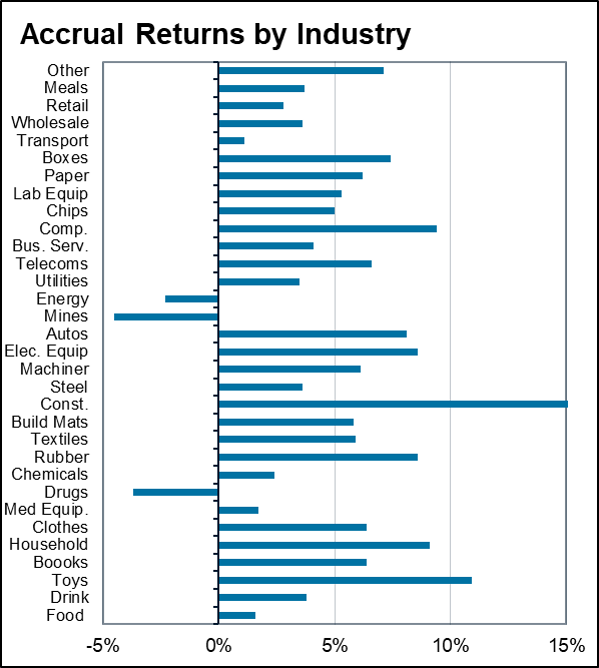

In the same way that reliability of estimates varies across accounting categories, it may also differ between industry.

Chan et al (2006) grouped accrual returns by industry. Whilst the strategy was generally positive, returns varied between industry:

- The strategy worked particularly well for Construction, Toys, Computer and Electrical Equipment and Household Goods;

- The strategy did not work in Energy, Mining and Drugs (and was weak in other areas).

This reflects two factors:

- Some industries are more reliant on certain accounting elements (e.g. working capital). This was the authors conclusion for the importance of accruals in the above industries which have a high working capital component; and

- For some industries, other factors are more more important to the share price than earnings estimation errors (e.g. commodity prices, drug approvals).

- Hedge fund returns for accruals strategy across industries.

Conclusion

Sloan’s seminal paper demonstrated that the base rate effects of accruals analysis were solid. However, like all financial studies, we need to recognise the limitations of this study and subsequent research:

- Firstly, the market is adaptive and will incorporate these findings (as per Green, Hand and Soliman 2009, there is already evidence that this is occurring);

- The study is based on top level aggregate data which contains many errors and generalilsations. As a result there will be a significant variance in results at an individual stock level. This offers both opportunities and risks.

- The sheer quantity of financial information allows for data mining that can enable many possible results.

A good indication of the limitations of this research was provided by Dechow, Ge and Schrand. Their meta analysis of > 300 studies related to earnings quality began by noting that…

“earnings quality is defined only in the context of a specific decision model”

… and then concluded:

“our … general observation about the state of the literature viewed in its entirety is that there is no measure of earnings quality that is superior for all decision models”

In essence, there is no simple, one size fits all, answer. We need to understand the individual questions we are asking and frame our analysis accordingly.

A starting point is to use the aggregate level of accruals to provide a rough Bayesian base rate probability. This base rate can then be adjusted depending upon the stock specific factors at work in each case. In this process we would start by ….

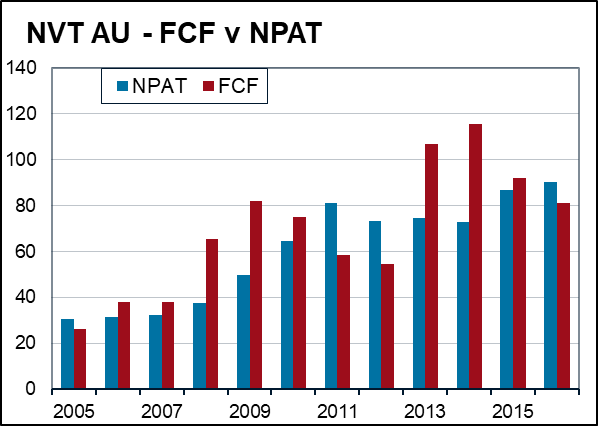

… considering this as Innocent until proven Guilty ….

… and this as Guilty until proven Innocent.

Our proof in each case would then involve:

- a bottom up analysis of the source of the accrual and its nature; and

- a broader contextual assessment of the motivations for the accrual.

If after this assesment we conclude there are meaningful accrual issues to consider, we must then decide whether these issues are meaningful to the overall investment decision.

This is the critical question of When is Earnings Quality Usesful?