“There are two consequences in history; an immediate one, which is instantly recognized, and one in the distance, which is not at first perceived. These consequences often contradict each other; […] look to the end of an accomplished fact, and you will see that it has always produced the contrary of what was expected from it”

A common refrain for investors is to ignore the short term noise and focus on the long term. But this is often easier said than done – every long term trend starts with short term outcomes. How do we distinguish what is important for the long term from short term volatility?

One way to do this is to reframe the question in systems terms. Investors should focus on understanding the systemic nature of the investment rather than undertaking mechanical analysis of the noise emanating from the system. In this context, the long term is determined by the general behaviour of the system, not the short term outcomes within the system. The importance of new information is whether it represents a change in this systemic behaviour or is simply variability within the system.

System Stability

To expand on this idea, a couple of simple systems concepts:

Stability vs Volatility

The first is the distinction between the stability of a system and its volatility. This is best done visually.

In the bowl at right, if the ball is dropped, or the bowl is wobbled, the ball will move. There will be volatility. However, the system is inherently stable. The ball will always have a tendency to move towards the bottom of the cup.

Conversely, the system represented by the bottom bowl is unstable. The starting point for the ball may be stationary, with no volatility. However, the slightest wobble will see the ball move. Furthermore, the end position of the ball cannot be predicted. Minute changes in its starting point or the direction of the wobble will result in very different outcomes.

Regime Shifts

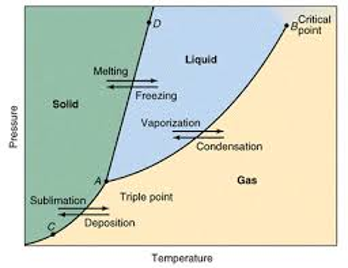

A second, related idea is a regime shift (or phase change), where a system switches, often suddenly, between different states.

The best example is H2O. At certain temperature and pressure it is liquid water. But slight changes in the environment can see it change to ice or steam. The behaviour of the system is vastly different in each of these states.

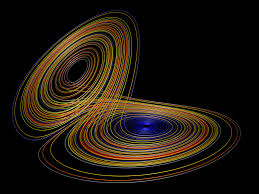

A nice visual representation of regime change is presented by plots of strange attractors. These systems have two or more “attractor” points to which the system gravitates, but the system can switch suddenly between these points.

Obviously in the real world, every system is made up of multiple shaped bowls in various states of balance and support. The system may be stable for one sort of wobble but not another. Some changes may simply cause variability within a part of the system. Other shocks might cause a regime shift between parts of the system and some events may change the operation of the system altogether.

The Importance of System over Signal

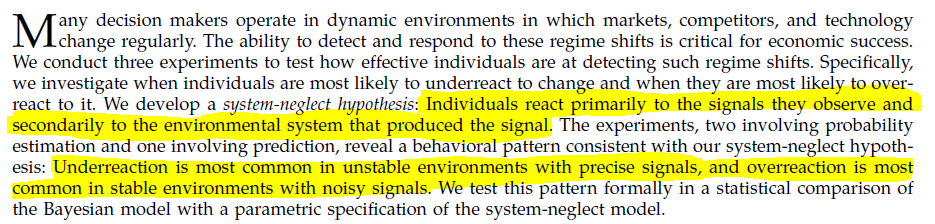

Despite the importance of systemic analysis of the whole rather than mechanical analysis of the parts, this approach doesn’t always come naturally. An interesting study examining how people respond to changes in underlying systems by Cade Massey and George Wu noted:

.

The study asked participants to make decisions about whether a regime shift had occured in a system based on knowledge about the initial state of the system and the outputs (noise) of the system. Systems were either stable with a low base rate probability of a regime shift (analagous to the top bowl diagram above) or unstable (the bottom bowl diagram). The results were as follows:

Where the system was stable, but with lots of intra system noise, decision makers tended to over-react to the noise and ignore that the base rate probability of a regime shift was low.

In contrast, where we the system was inherently unstable, but the signals eminating from the system appear precise, then decision makers tended to under-react.

Its worth noting that the participants in the study were generally correct in interpreting the direction of change implied by the information. What they got wrong was the amount of their reaction – sometimes under and sometimes over -reacting to information. The parallels to investing are obvious. Prices generally move immediately up or down on good or bad news. The trick for investors is knowing whether this represents threat or opportunity. Has the market under or over-reacted to the news?

Stock Market Examples

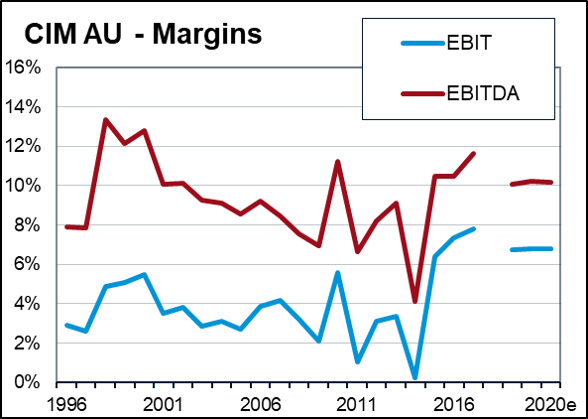

A classic example of a stable, but noisy, stock would be construction contractor CIM.

The business is exposed to regular external cycles of demand as well as internal margin cycles driven by individual contracts. This creates lots of noise in the short term profit outcomes of the business.

Nevertheless, the construction industry has been around for a long time and is not likely to suffer any major technological disruption. In addition, as by far the largest player in the industry, the operating assets of the business should be reasonably resilient to competitive threats.

In summary, there will be lots of volatility in sales and margins, but the business should endure. Investors can profit by buying when this noise is negative, reasonably confident in the long term stability of the system.

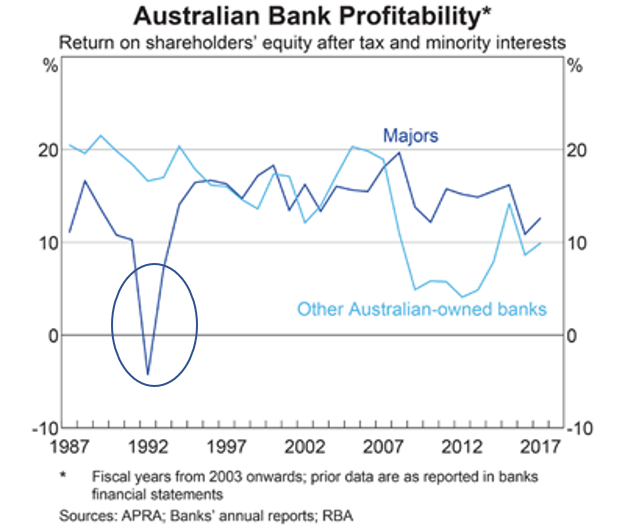

In contrast, an industry with seemingly precise earnings, but inherent instability, is banking. From period to period earnings changes are generally small. However, every now and then the industry faces a regime shift – moving from a cycle of expanding credit and asset values to a different cycle of contracting credit and asset values. This combination of credit feedback and high balance sheet leverage makes equity values inherently unstable.

In this industry a negative share price reaction to certain news might actually be a threat rather than an opportunity. Buying the dip can be very risky (just ask Bill Miller).

Conclusion

The aim of this post is to highlight the importance of thinking about investments and companies through the Systems Frame. A focus on systems provides better understanding of the range of long term outcomes as well as offering a framework for analysing the significance of current news flow. Given that this sort of thinking generally doesn’t come naturally, it might also provide comparative advantage relative to other investors.

There are obviously many nuances in the systems approach. These will be the topic of future posts.