Earnings Quality Analysis – The Accruals Framework

There is no true number in accounting, and if there were, auditors would be the last to find it.

Overview

There are four steps to undertaking earnings quality analysis:

- Understand the “true” earnings of the business

- Consider the type of places where earnings quality is likely to arise

- Utilise an Earnings Quality Framework to interpret EQ

- Chose an Earnings Quality Tool to undertake the analysis.

In this section we are focussed on step three, utilising an Earnings Quality Framework, which in this particular case is the Accruals Framework.

Accrual accounting is based on matching revenue and expenses to the period in which they are incurred, rather than the period in which cash flows. Accruals can take a wide variety of forms, but common examples are capex and working capital (receivables, inventory, payables).

In developing an Accruals Framework, we can start with a top down measurement of Accruals:

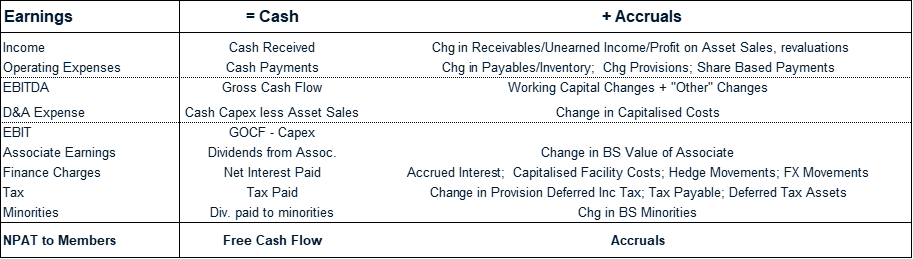

This in turn can be broken down into a bottom up analysis of accruals pairing each element of the P&L with its corresponding accrual:

Our discussion of The Accruals Framework involves three steps: